Victoria is getting a lot of renewables. So much so, that one gigawatt of battery storage could mean it no longer needs the 45-year-old Yallourn brown coal power station next year.

Let me explain.

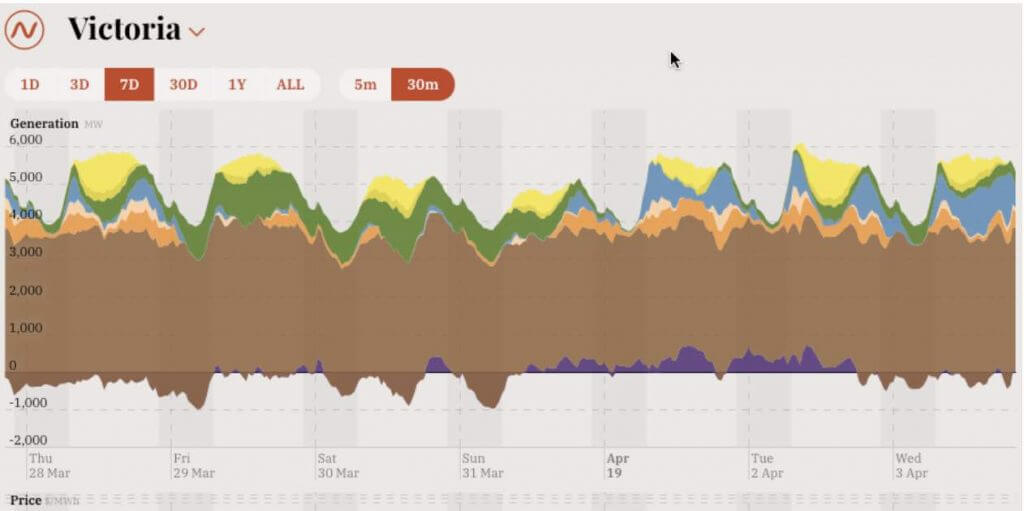

Here is screenshot from opennem.org.au of a week’s generation and demand in Victoria in March. You can see the majority of power supplied by brown coal, with some wind (in green) on Friday to Sunday, rooftop solar (yellow) and some solar farm generation (orange) each day, and hydro (blue) on higher demand lower wind days.

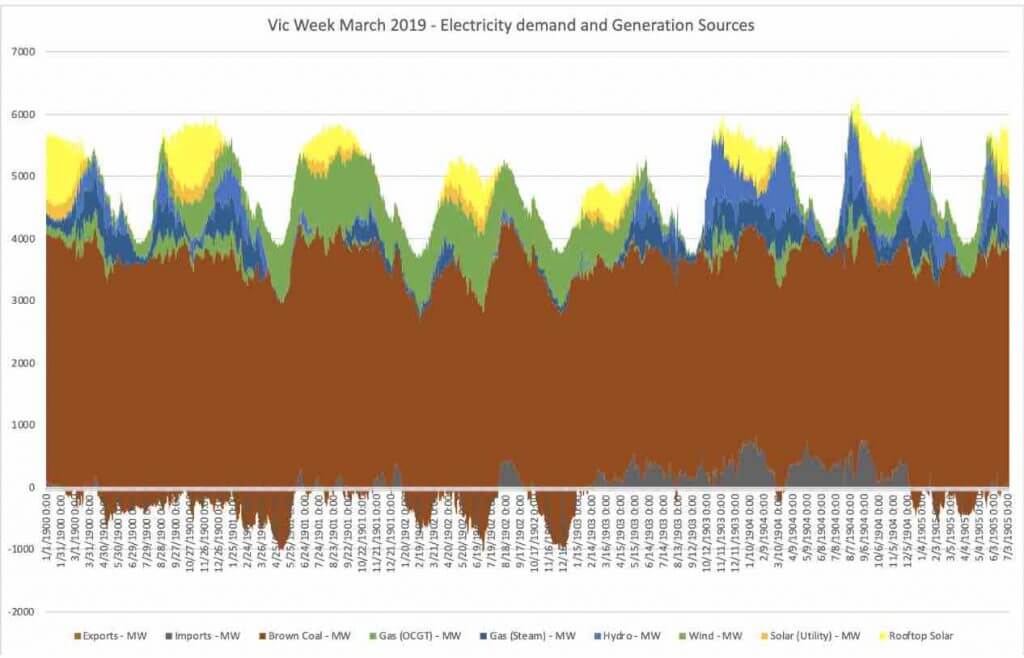

I downloaded this data, and created my own graph of the same data. Shown below:

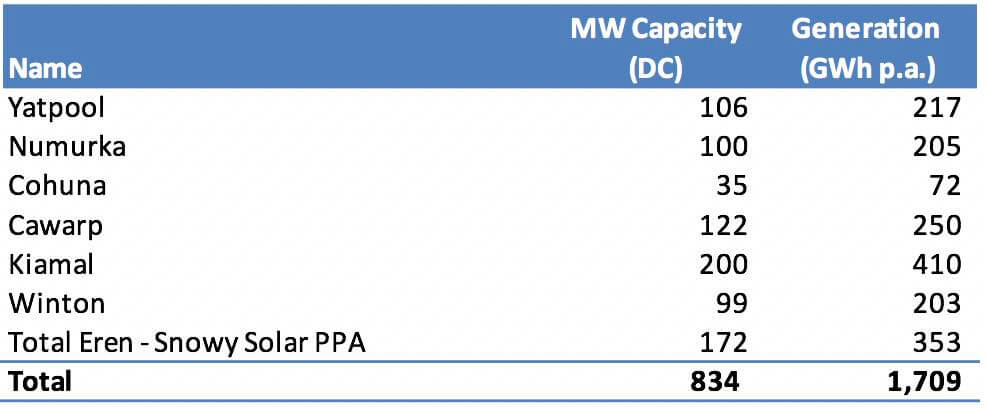

There are many solar and wind farms in Victoria under construction and due to connect in the next 12 months. Here are the solar farms:

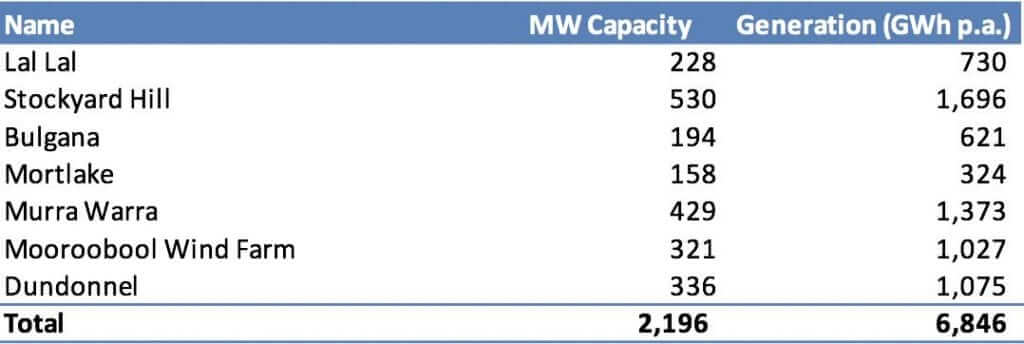

And here are the wind farm under construction or commissioning in Victoria currently:

It is quite a bit of wind power. These wind projects alone will meet 15% of Victoria’s annual electricity use. This will take Victoria annual electricity needs served 25% from wind power and 10% by solar power.

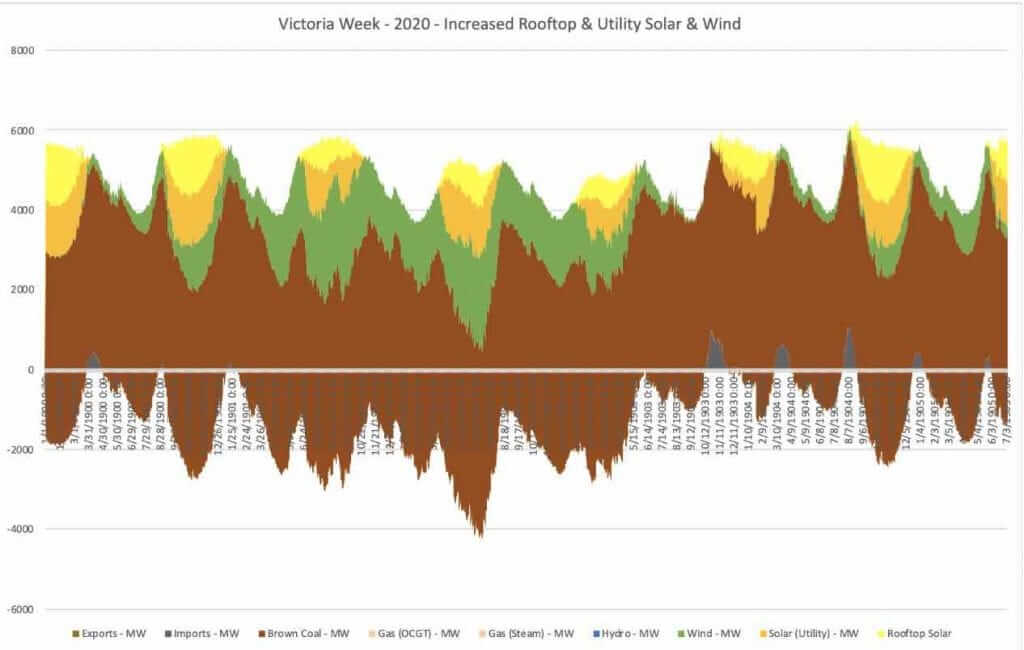

To see how this new generation will change Victoria’s generation mix and balance of supply and demand, I scaled up the current wind, utility solar and rooftop solar by factors of 2.1, 4.9 and 1.5 respectively. These factors are the likely change/increase of generation by these technologies in 12-18 months’ time as the current pipeline is completed.

The graph below shows these scaled up variable renewable generation profiles, over the same 7 day period. It also includes brown coal going consistently at its rated capacity of 4,700MW, which it typically does when possible, except during shoulder seasons.

For simplification, gas and hydro generation has been taken out, and it can be seen that it is unlikely to be needed very often.

The graph shows a mix of brown coal, solar and wind mostly meeting demand easily, with limited need for imports, hydro or gas.

More alarmingly, the graph shows a masses amount of excess electricity, particularly when solar and wind combine to meet around 94% of demand. At this time in this model, there is over 4,000 MW of electricity in excess, available for storage or inter connectors.

But times of excess of over 2,000 MW of electricity occurs in 5 of the 7 days.

Currently, Victoria has very little storage in the form of batteries or pumped hydro that can soak up electricity during high supply or low demand times. Unlike NSW, which has 1,060MW, and Queensland, which has 500MW of pumped hydro capacity.

About 500MW of excess Victorian electricity can be exported to Tasmania via Basslink, and another 1,350MW to NSW, totalling 1,850MW of export potential.

Victoria can also export 820 MW to South Australia, but it is often windy and sunny in Victoria and South Australia at the same time, due to similar weather patterns, so this might not be possible.

Of course, if it is during daylight hours, Victoria may also not be able to export to NSW too due to solar generation in NSW and Queensland.

This means 2,000 to 3,000 MW of excess generation at some times that has nowhere to go, and may have to be spilled or curtailed.

With wind coming and going over 3-7 day cycles and seeing times of high generation, it appears curtailment by AEMO may be necessary soon in Victoria. Particularly when there is high wind generation during solar generation times.

For the above modelling, brown coal power generation is set to 4,700MW constantly. In reality, Victoria’s brown coal power stations aren’t achieving this. For the original study week, it sat around 3,900 MW with 2 units not operating.

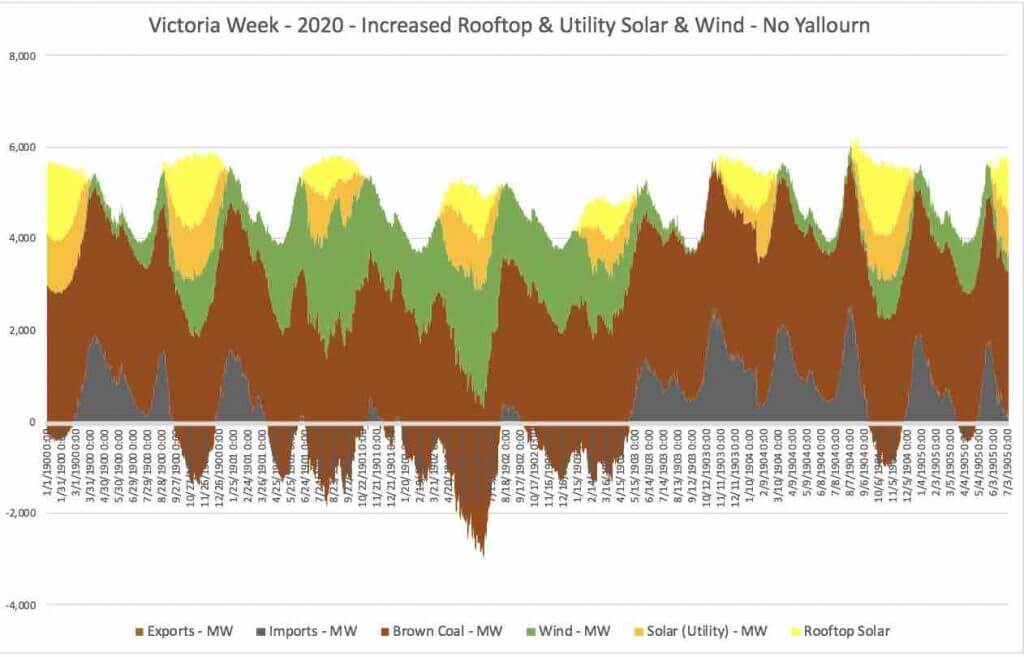

The graph below shows the same week and data with the 1,480 MW Yallourn power station removed:

Without Yallourn, we see imports reach 2,545 MW and exports up to 2,954 MW, but they do not last long.

This is where batteries could come in. Battery energy storage systems, like the Tesla Big Battery in Hornsdale, or the Gannawarra battery next to the solar farm of the same name in Victoria, can absorb excess power generation and then provide power when needed to meet peak demand.

This balances the system. Judging by the graphs for this March week, 500MW and 500-1000MWh of batteries could stabilise the system, reduce curtailment and help meet peak demand.

With all NEM states going solar, transmission lines have limited value balancing supply and demand, if all states have abundant solar.

Batteries can absorb this excess solar for later use. While pumped hydro is also attractive, like transmission lines they take at least 5 years to plan and build.

There are also many other options, such as demand response, shifting hot water production from night time to daytime, and orchestration of electric vehicle charging, which are all important to progress.

It is a good time to say, that this is a cursory high level analysis to highlight an upcoming substantial change to the Victorian electricity market. There are many with much more resources to look at this more closely and form more detailed conclusions.

The Victorian Renewable Energy Target has been successful in contracting over 900MW of new wind and solar in 2018, projects which are currently under construction.

It could replicate this effort to enable investment in 1GW of grid batteries over the next 12 months. This could be done via similar reverse auctions for battery energy service contracts, or even a direct investment and asset recycling program.

The Victorian grid can survive without the batteries, but GW of new batteries could magnify the benefit of the new wind and solar projects and prepare for retirement of the next coal power station.

While Tasmania’s so called Battery of the Nation (pumped hydro) and the Snowy 2.0 pumped hydro projects are on the horizon, such a scale of grid batteries can happen relatively quickly, will remain a good investment and valuable asset for the Victorian grid moving forward, and enable even greater investment in wind and solar post 2020.

It is amazing to consider that Victoria has been recovering for the past 2 years from the sudden closure of Hazelwood Power station, in terms of electricity supply and prices. But now it is within grasping distance of being ready for the retirement of its next coal power station.